“We are like hunters and gatherers” – Pam Liou

Last week we received a lot of good feedback, particularly on what group of users we should focus on first. It came down to freelancers. There are a lot of opportunities in this market because of various reasons:

- lack of financial management tools that support specific needs of freelancers (personal + business accounts and multiple companies/clients/projects)

- lack of standards on rates and best practices

- growing market (more recent graduates are doing independent work)

- I have understanding of everyday challenges of freelancers (freelance experience, and hiring freelancers/contract workers)

These opportunities also present challenges, namely the fragmentation of the market and lack of consistent documentation/census (not to mention international workers). Luckily, there is the Freelancers Union, which provides data on their members and have a lot of useful content in one centralized place.

53MM freelancers in the US

Based on a 2014 survey commissioned by FU and Elance-oDesk there were 53MM freelancers in the US.

“Gone are the days of the traditional 9-to-5. We’re entering a new era of work — project-based, independent, exciting, potentially risky, and rich with opportunities.”

“There are more avenues available to find work, to make contacts, to connect with others, etc. thanks to technology and its ability to network.”

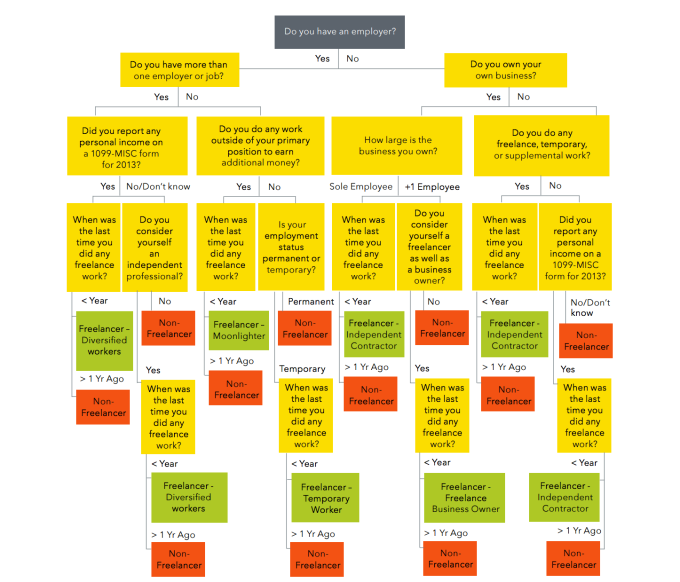

- 40% independent contractors: don’t have employer, work on a project by project basis

- 27% moonlighters: have employer, moonlight on the side

- 18% diversified workers: combination of different work types (full time secretary + uber driving + freelance writing project)

- 10% temporary workers: single employer/client that is temporary (1-2 months)

- 5% freelance business owners: 1-5 employees, also considers freelancers

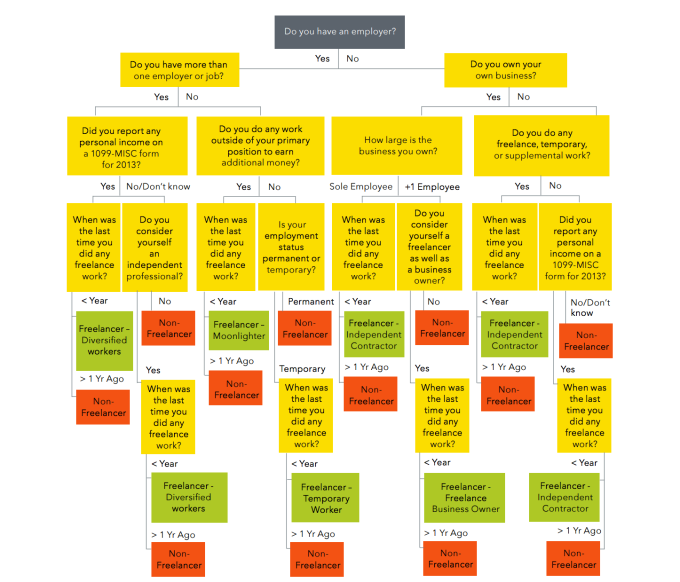

Here’s a great tree of the interview questions they used to categorize the workers.

FU also provides a report on their members. Here are some useful summaries from the post.

Key takeaways

- For Millennials, freelancing is the new normal.

- Concentration in the following fields

- artists & creatives (38%)

- services & sales (25%) — Lawyers, nannies, accountants, chefs, yoga instructors (kind of all over the place)

- writers & editors

- tech & web dev

- Cities: New York still has the majority of FU membership (over 60%), other cities are (from highest growth to lowest)

- LA, SF, Portland, Detroit, Baltimore, Milwaukee, Kansas City, Denver, Austin

#FreelanceIsntFree

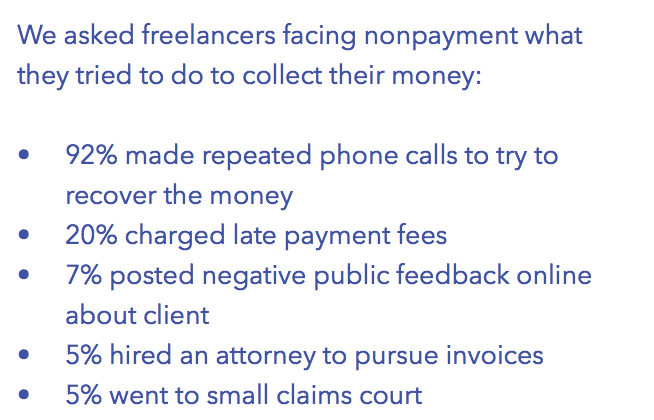

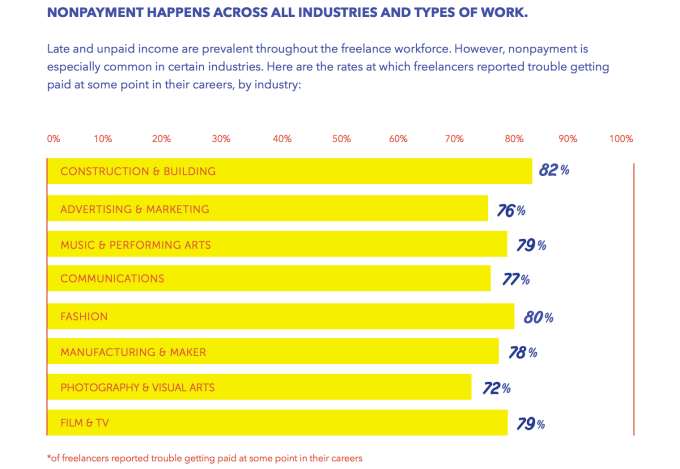

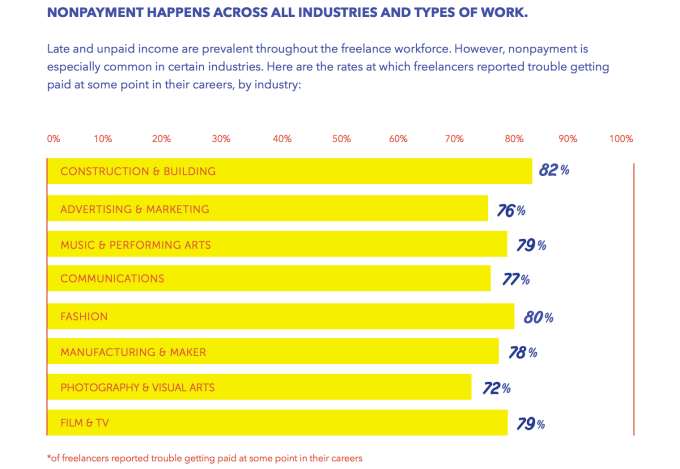

Biggest challenges for freelancers: nonpayments and late payments

- “One in every two freelancers had trouble collecting payment in 2014”

- The average unpaid freelance worker loses almost $6000 annually – which accounts for 13% of their total income

It would be helpful to have a Glassdoor for freelancers with features such as report nonpaying companies and ratings, and help with written contracts.

There needs a way for freelancers to assess the risk of not getting paid by a company, and weigh the importance of experience/portfolio showcase piece vs. financial earning.

Frequent offenders:

- 43% of respondents had trouble collecting payment from microbusinesses (1-5 employees)

- 40% had trouble collecting payment from small businesses (5-49 employees)

- 36% had trouble collecting payment from medium (50-149 employees) and large (150+ employees) businesses

Most freelance engagements aren’t protected by clear, written contracts.

- Only about one-quarter of freelancers (28%) say they always use a contract

- 33% say they always put the terms of agreement in an email

- 42% always use a verbal agreement

- 21% of freelancers have worked with clients who have refused to sign a contract